Repudiation of contract before due date Sale of Goods Act, 1930 Bare Acts Law Library

Contents

On 22nd August, 2009, appellant received a letter from respondent No. 2 stating that his claim had been repudiated as the appellant had a history of hyperlipidaemia and diabetes and the policy did not cover per-existing conditions and complications arising therefrom. The said repudiation was with regard to Bill No.1 i.e. the bill raised by the Medical Centre for USD 2,29,719. The appellant protested against the repudiation and requested his claim to be settled on a priority basis as the Medical Centre and the other centre in the USA where he had taken treatment had started pressing for release of payment. However, by its letter dated 9th April, 2010, respondent No.1 reiterated its repudiation of the claim made by the appellant.

Whether the Life insurance will cover a death due to alcoholism will depend on the specific terms particularly the exclusions of the policy. But it is important to note that insurers may be hesitant to issue policies to individuals who engage in risky behaviors such as heavy alcohol consumption or drug abuse. If somebody decides that he or she now needs to satisfy his or her part of a contract after repudiation. He or she would wish to make it clear to the opposite get together that he or she will now conform to the contract. He or she will also grant the opposite get together that didn’t breach the contract some form of compensation for the delay in the contract achievement. So with the law as it is, delays in efficiency – even outside the control of the parties – can result in rights to terminate bad contracts and business relationships which have soured.

That message digest is then encrypted with the sender’s private key. The act of encrypting the message digest with the sender’s private key produces the digital signature. That digital signature is then appended to the message and sent to the receiver. The receiver must then verify the digital signature by decrypting it with the sender’s public key and comparing the result with the message digest of the received message. The purpose of a digital signature is to provide the same level of accountability for electronic transactions where a handwritten signature is not possible or feasible. If we have interaction an exterior party to promote our products, then we may inadvertently create a business agency relationship and provisions in our contract could also be overridden by laws that protect the agent.

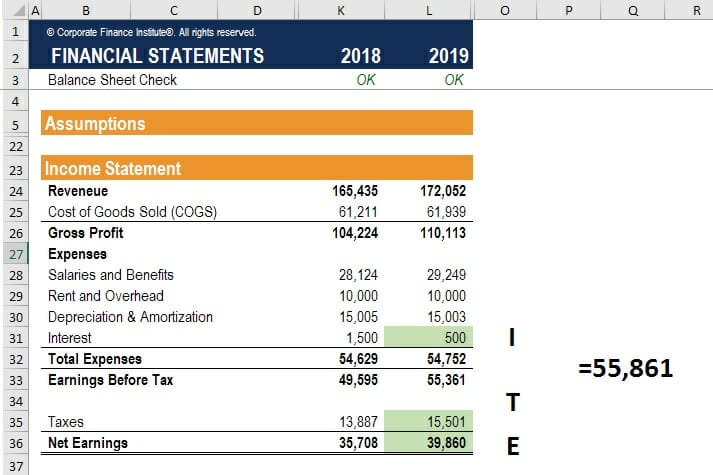

If you are a Financial Advisor, then it is extremely important to stay updated on the latest financial terms. We at IndianMoney.com update all the new terms used in personal finance in the Financial Dictionary. This is a double bonanza of increasing your efficiency and fetching clients more money. We have developed this Financial Dictionary that could be used by anyone for free on our website. We have provided the meanings of almost all the financial terms along with the context in which they can be used.

Meaning Summary

V. Dalbir Kaur – AIR 2020 SC 5210, a proposal form was submitted to the appellant therein for a life insurance policy containing questions pertaining to the health and medical history of the proposer and required a specific disclosure as to whether the proposer had undergone any treatment. Further a query regarding specific diseases or disorders suffered was also responded to in the negative. A policy of insurance was issued by the insurer on 12th August, 2014, insuring the life of the proposer for a sum of Rs. 8.50 lakhs payable on maturity with the death benefit of Rs. 17 lakhs. On 12th September, 2014, the insured, Kulwant Singh, died giving rise to a claim under the policy. The claim was subjected to an independent investigation and the records revealed that the deceased had been suffering from hepatitis C.

It is therefore crucial to accurately disclose any potentially relevant information first hand when applying for life insurance, including any history of alcohol consumption, to ensure that the policy remains valid and the death benefit will be paid to the beneficiaries as intended. A cheap value is required to be paid for work performed at the request of the opposite get together. An anticipatory breach is an motion in contract law that shows a party’s intent to desert or forgo their obligations to a different party. It simply allows the innocent get together to find out how they need to proceed.

- And if a contracting party tries to terminate a contract and does to have the best to, is itself in repudiatory breach of contract.

- The duty of full disclosure required that no information of substance or interest to the insurer be omitted or concealed.

- The injured party can cancel or repudiate the contract as soon as the anticipatory breach occurs, and launch an action for damages for the anticipatory breach of contract without having to wait for the contract’s due date.

- The spouse of the assured therein submitted a claim under the terms of the policy after the death of the assured.

He also stated that he had informed the physician, Dr. Jitendra Jain, who examined him prior to obtaining the policy, of the medicines he had been taking. Therefore, the insurance company was well aware of the fact that the insured was a diabetic and was taking all necessary medication for preventing further complications and controlling the disease. Hence in our view, there was no suppression of any material fact by the appellant to the insurer. Therefore, the respondents were not right in stating that as per the terms and conditions of the policy “all the complications arising out of pre-existing condition is not payable.” As already noted, acute myocardial infraction can occur in a person who has no history of diabetes mellitus-II. One of the risk factors for the aforesaid cardiac episode is diabetes mellitus-II. The fact that the appellant had diabetes mellitus-II was made known to the insurance company.

Join Taxguru’s Network for Latest updates on Income Tax, GST, Company Law, Corporate Laws and other related subjects.

Put merely, determining repudiation requires an in depth evaluation of the particular terms of the contract and the obligations of every party, after which the conduct and statements of the events. In the context of the case of repudiation, it may be that the repudiating get together is unwilling or unable to perform their obligations beneath a contract. Repudiation is seen to be fairly a critical matter and the court docket requires a ‘clear indication’ that a party is unready or unwilling to carry out the contract. When repudiation occurs before the precise breach of a contract, it can be known as an anticipatory breach. Repudiation of a contract occurs where one party renounces their obligations underneath a contract. One way is when somebody makes a direct statement that the or she will not fulfill his or her a part of a contract, and the courts will then see this as express repudiation.

The anticipatory breach takes effect as premature destruction of the contract rather than as a failure to perform it in its terms. The Indian Supreme Court has time again followed the doctrine of anticipatory breach of contract following the precedents of English courts to secure the end of justice as discussed hereinabove. Monetary Damages – It includes a sum of money that is awarded as a compensation for the financial losses suffered by the party against whom the anticipatory breach has been committed.

What is an example of repudiation?

What may be a material fact in a case would also depend upon the health and medical condition of the proposer. D) In Kamgarh Shah v. Jagdish Chandra AIR 1960SC 953, it was observed that where there is an ambiguity it is the duty of the court to look at all the parts of the document to ascertain what was really intended by the parties. But even here the rule has to be borne in mind that the document being the grantor’s document it has to be interpreted strictly against him and in favour of the grantee. A proposer may find it convenient to bracket together two or more questions and give a composite answer. There is no objection to his doing so, provided the insurers are given adequate and accurate information on all points covered by the questions. Where an answer is unsatisfactory, as being on the face of it incomplete or inconsistent the insurers may, as reasonable men, be regarded as put on inquiry, so that if they issue a policy without any further enquiry they are assumed to have waived any further information.

In an ARP spoofing attack, a malicious party sends spoofed ARP messages throughout a neighborhood space community to be able to hyperlink the attacker’s MAC tackle with the IP handle of a reliable member of the community. This kind of spoofing assault results in knowledge that’s supposed for the host’s IP handle getting sent to the attacker as an alternative. Malicious events generally use ARP spoofing to steal data, modify information-in-transit or stop traffic on a LAN. When both parties to a contract have performed all their obligations beneath a contract, together with all express and implied phrases a contract comes to an finish. Delays caused by unexpected occasions affect a contracting parties’ ability to carry out contract.

Definition of Repudiation

However, having regard to the inference mentioned in head above, the mere leaving of a blank space will not normally be regarded as sufficient to put the insurers on inquiry. An answer which is literally accurate, so far as it extends, will not suffice if it is misleading by reason of what is not stated. It may be quite accurate for the proposer to state that he has made what is repudiation a claim previously on an insurance company, but the answer is untrue if in fact he has made more than one. If a fact, although material, is one which the proposer did not and could not in the particular circumstances have been expected to know, or if its materiality would not have been apparent to a reasonable man, his failure to disclose it is not a breach of his duty.

Repudiation of Insurance Contract

Since this was disclosed by the complainant to medical authorities in the USA, the Commission found that there was no reason why he could not have disclosed the condition to the respondent- insurance company at the time of obtaining the mediclaim policy. The insurer must be able to assess the likely risks that may arise from the status of health and existing disease, if any, disclosed by the insured in the proposal form before issuing the insurance policy. G.M. Channabasemma 1 SCC 357, it was observed that there is an obligation upon the assured to disclose all material facts which may be relevant to the insurer but after issuing a policy, the burden of proving that the insured had made false representations and suppressed material facts is on the insurer. In the said case, it was held that the physician’s statement did not lead to a conclusion that the respondent therein was influenced by a serious disease for a long time. The finding of the Trial Court that the assured had committed fraud on the insurer while taking out the policies was reversed and the appeal was allowed.

One of the risk factors for the aforesaid cardiac episode is diabetes mellitusII. The fact that the appellant had diabetes mellitusII was made known to the insurance company. Specific https://1investing.in/ Performance of Contract – Specific performance of the contract is an equitable remedy available in case of anticipatory breach of contract or an actual breach of contract.

However, after reading the contents of the letter, it was evident that the contractor unilaterally terminated the contract and notified the appropriate department, as well as resigning from the PWD Manipur contractor list. As a result of this letter, the contract was rejected, and the authorities’ acceptance of the letter was not required to terminate the contract, however, a breach could result in a damages action. It also involves a monetary award as compensation for the financial losses experienced by the party who was the victim of the anticipatory breach.

Further, the exemption of liability clauses in insurance contracts are to be construed contra proferentem, in favour of the insured in case of ambiguity vide Sushilaben Indravadan Gandhi v. New India Assurance Co. B) In Life Insurance Corporation of India v. Manish Gupta, 11 SCC 371, the respondent therein had obtained a mediclaim policy from the appellant insurer. The proposal form sought disclosure of health details and medical information of the assured. With regard to the query as to whether the proposer/assured had suffered from any “cardio-vascular disease e.g. palpitations, heart attack, stroke, chest pain,” the assured answered in the negative. A claim for treatment expenses was made by the hospital where treatment was administered and the said claim was repudiated by the insurer on the ground of nondisclosure of pre-existing cardiac condition.

If specific queries are made in a proposal form then it is expected that specific answers are given by the insured who is bound by the duty to disclose all material facts. Where the space for an answer is left blank, leaving the question un-answered, the reasonable inference may be that there is nothing to enter as an answer. If in fact there is something to enter as an answer, the insurers are misled in that their reasonable inference is belied.

Deixe um comentário